Bad Faith Insurance Attorneys Serving Clients in Denver, the Metro Area, and All of Colorado

It may be in your best interest to consult a Denver bad faith insurance lawyer if you are concerned that an insurance company is not dealing with you fairly. There are many different circumstances where insurance companies may act in bad faith, including personal injury matters.

Attorneys at Burg Simpson Law Firm have extensive experience representing plaintiffs in personal injury claims. We have an in-depth understanding of how insurance companies operate, enabling us to identify instances of bad faith and fight for coverage of your losses (and any additional damages you are due).

Speak to a Denver bad faith insurance lawyer about your case today. Call Burg Simpson at 303-792-5595 today for a FREE and confidential case evaluation. Our lawyers serve clients in Metro Denver and other areas of Colorado.

What Is Bad Faith in Insurance Law?

In insurance law, bad faith occurs when an insurance company does not deal fairly with a policyholder or an insured. Motorists, homeowners, and others have a right to expect that, in exchange for their premium payments, the insurance company will come through when a claim is filed.

Not every claim will be paid, of course, but it is reasonable to expect that the insurance company will investigate the reported loss promptly, issue a timely decision on whether the policy covers the loss, and make payment if the claim is approved. Insurers that engage in bad faith practices not only violate their contractual obligations, but undermine the trust and confidence that policyholders place in the insurance industry.

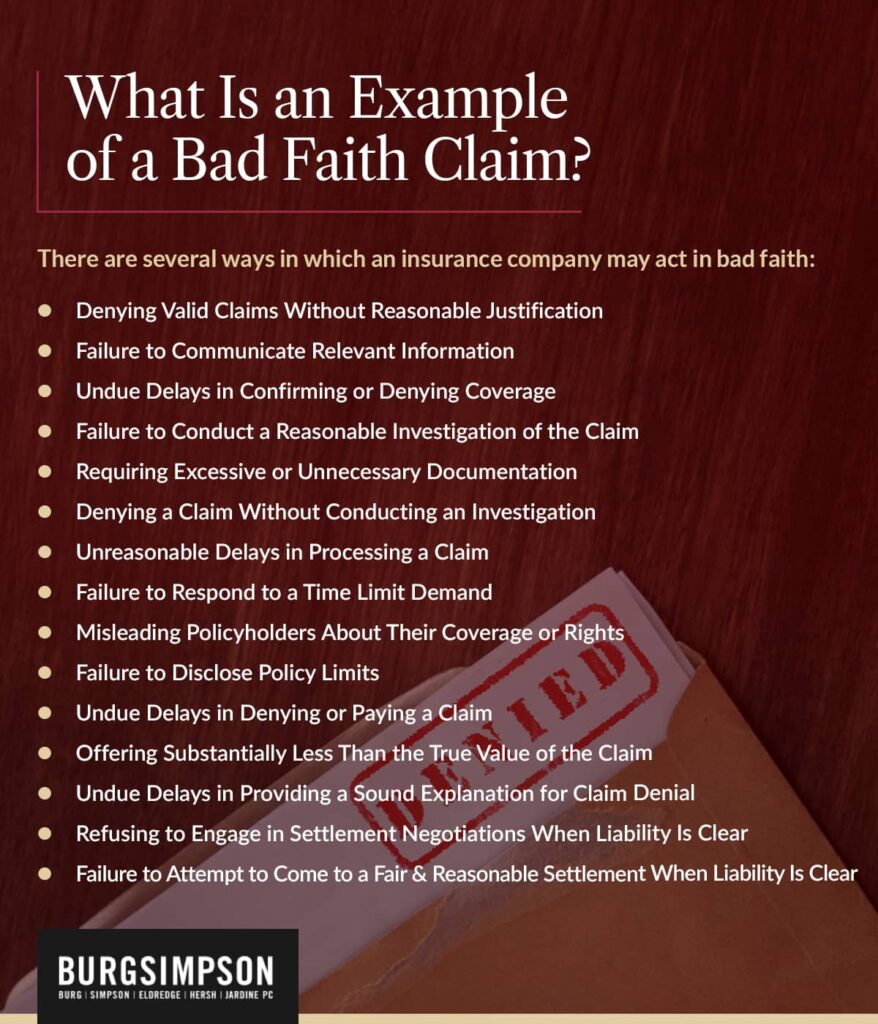

Examples of Insurance Bad Faith

Delays and adverse decisions by insurers do not necessarily constitute bad faith insurance practices. A Denver bad faith insurance lawyer can review the contract with your insurer and review applicable state laws to determine whether bad faith has taken place.

There are several ways in which an insurance company may act in bad faith:

- Denying valid claims without reasonable justification

- Failure to communicate relevant information to the insured

- Undue delays in confirming or denying coverage

- Failure to conduct a reasonable investigation of the claim

- Requiring excessive or unnecessary documentation

- Denying a claim without conducting an investigation

- Unreasonable delays in processing a claim

- Failure to respond to a time limit demand

- Misleading policyholders about their coverage or rights

- Failure to disclose policy limits

- Undue delays in denying or paying a claim

- Offering substantially less money to settle than the true value of the claim

- Undue delays in providing a sound explanation for claim denial

- Refusing to engage in settlement negotiations when liability is clear

- Failure to attempt to come to a fair and reasonable settlement when liability is clear

Another duty insurers have to policyholders is called indemnification. Simply put, the insurance carrier is obligated to defend any lawsuit or judgment entered against the insured that falls within the policy coverage. Insurers must also consider the insured’s interests as much as their own when deciding whether to agree to a settlement. Failure to do so can leave the insurance company liable for a subsequent judgment against the insured.

Insurance is one of those things that nearly everyone has, but almost no one understands. An insurance company may take advantage of this situation, acting in bad faith while insureds and policyholders are none the wiser.

A Denver bad faith insurance lawyer will ensure that your rights are protected. Burg Simpson Law Firm has the experience, skill, and resources to take on insurers of any size.

What Is the Bad Faith Law in Colorado?

Insurance company regulations in Colorado do not use the term “bad faith.” Colorado’s prohibition of “improper denial of claims,” however, does protect consumers from what are generally construed as bad faith insurance practices.

“A person engaged in the business of insurance shall not unreasonably delay or deny payment of a claim for benefits owed to or on behalf of any first-party claimant.”

– Colorado Revised Statutes § 10-3-115

A first-party claimant is an individual or entity covered by the insurance policy (i.e., the policyholder or an insured on the policy). Delay or denial of payment is considered unreasonable if the insurance company does not have a “reasonable basis” for such an adverse decision.

What constitutes a “reasonable basis” for these decisions is left open-ended. Insurance companies will almost certainly argue that any delay or denial of a benefit is reasonable, which is why you need a Denver bad faith insurance lawyer to act on your behalf.

Do I Have a Bad Faith Insurance Claim?

There are multiple scenarios where legal action may be taken against an insurance company for bad faith, including:

- Car insurance claims

- Health insurance claims

- Disability benefits claims

- Homeowners and renters insurance claims

- Life insurance claims

(It is important to note that workers’ compensation insurance is subject to different rules. You should speak to a qualified attorney if you are dealing with a workers’ comp dispute.)

Ultimately, the goal of a bad faith insurance claim is twofold. The first is to obtain the payment or benefit you are due under the insurance policy, and the second is to pursue compensation for any additional damages you have sustained.

Bad faith insurance claims may be brought on common-law grounds or on the basis of breach of contract. A knowledgeable lawyer can advise you which of these grounds applies in your situation and assist you with all aspects of the case.

Who Can Sue for Bad Faith?

Both first-party and third-party insurance claimants can bring legal actions for bad faith. A third-party claimant is an individual who makes a claim against someone else’s insurance policy (e.g., a liability claim made against another driver’s auto insurance for losses suffered in a car accident).

Personal injury law is the principal focus of our Colorado law firm. We are well-versed in the tactics insurance companies use to try to avoid payouts, from lowball settlement offers to outright bad faith. Our attorneys are prepared to hold any insurance companies involved in the case—whether it is “your” insurance company or the defendant’s carrier—accountable for bad faith practices.

Are Auto Insurers Required to Act in Good Faith?

All insurance companies doing business in Colorado are required to uphold a duty of “good faith and fair dealing.” This includes auto insurers.

If you are involved in an auto accident, it is vital to understand the following types of coverage:

- Uninsured Motorist (UM) covers the damages incurred due to the negligence of an uninsured driver. UM coverage is optional in Colorado, but drivers are strongly urged to purchase this insurance to avoid being forced to pay the costs of an uninsured motorist accident on their own.

- Underinsured Motorist (UIM) is a provision that allows a victim to receive compensation after an accident with an at-fault driver whose liability limits are not adequate to cover damages and medical expenses. Your insurance will cover the gap between the expenses and what the at-fault driver’s insurance will pay.

- Medical Payments (Med Pay) coverage pays for immediate and necessary medical services following a car accident that results in injury.

Car accidents can result in substantial damages. In addition to a claim against the at-fault driver, victims often turn to their UM/UIM and/or medical payments coverage to offset the costs.

Unfortunately, bad faith on the part of an auto insurer can leave you without the financial resources you need to recover from the accident. If a claim is made against you, an insurance company acting in bad faith may leave you responsible for paying an injured party’s costs out of pocket.

A Denver bad faith insurance lawyer can help you avoid these outcomes and assert your rights. Burg Simpson has the experience and resources to handle bad faith insurance claims against car insurers.

What Damages Can I Recover for Insurance Bad Faith?

Several types of damages may be recovered by a plaintiff who suffers losses as a result of bad faith by an insurance company. These include:

- Actual damages: In common-law claims, the plaintiff is entitled to compensation for all actual damages incurred as a result of insurance bad faith. This may include both economic and non-economic losses.

- Statutory remedies: Should the court find for the plaintiff in a first-party statutory claim, the court must calculate the dollar value of the insurance benefit that the plaintiff is owed. Plaintiffs in statutory claims may also be entitled to attorneys’ fees, court costs, and “two times the covered benefit” (see Colo. Rev. Stat. § 10-3-1116).

- Punitive damages: An award of punitive or exemplary damages may only be made if the court determines that bad faith practices by an insurance company were attended by “fraud, malice, or willful and wanton conduct” (see Colo. Rev. Stat. § 13-21-102).

The rules surrounding the elements of liability and damages available for bad faith insurance are highly complex. It is in your best interest to consult an experienced attorney in Denver, Colorado, for assistance with your claim.

Contact an Insurance Bad Faith Lawyer for FREE

What Is the Time Limit to File a Bad Faith Insurance Claim in Colorado?

The time limit for bringing a legal action is known as the statute of limitations. In Colorado, most tort claims (i.e., a legal claim seeking recompense for losses occurring due to negligence or wrongdoing) are subject to a 2-year statute of limitations (see Colo. Rev. Stat. § 13-80-102). The majority of lawsuits against an insurance company for bad faith must be filed within 2 years.

Colorado law provides an exception for claims involving uninsured/underinsured motorist (UM/UIM) coverage. These claims are bound by a 3-year statute of limitations (see Colo. Rev. Stat. § 13-80-107.5). An additional year provides claimants with extra time to determine if a bodily injury liability claim may be made against the at-fault driver and whether the insurance coverage (if applicable) is sufficient to cover the victim’s losses.

We recommend speaking to a Denver bad faith insurance lawyer as soon as possible. Doing so is the best way to ensure that there is enough time to pursue legal action against an insurance carrier that engages in bad faith.

How Burg Simpson Can Help

Insurance companies are large and powerful. As Good Lawyers. Changing Lives.®, our goal is to prevent insurers from taking advantage of claimants and fight for an optimal result.

Burg Simpson can handle all aspects of your case, including:

- Evaluating your insurance policy and the claim you submitted

- Investigating the claim for evidence of bad faith

- Submitting a letter to the insurance company demanding payment

- Negotiating a favorable resolution on your behalf

- If necessary, preparing a lawsuit and filing the documents with the appropriate court

- Preparing the case for trial

- Representing you in pre-trial hearings and at trial

Insurance companies are all about the bottom line. Their decisions are made based on math, not concern for the insured’s well-being. Claims may be denied, delayed, or inadequately defended if the numbers say it is more expensive to pay.

Our seasoned attorneys can determine if these decisions represent bad faith on the part of the insurance company. Burg Simpson has decades of experience obtaining fair compensation from insurers.

Why Choose Burg Simpson?

Contact a Denver Bad Faith Insurance Lawyer Today

You pay insurance premiums every month. When you have to make a claim, you expect the insurance company to show you the courtesy of dealing with you fairly. Unfortunately, insurance carriers often delay investigations, fail to communicate with or disclose important information to claimants, and even deny valid claims. In these situations, you need aggressive legal representation.

Burg Simpson was founded in Colorado in 1976. Today, we are an award-winning national law firm that still maintains local clout in the cities and states we serve.

View Our Awards & Accolades

Insurance bad faith claims often involve principles of personal injury and insurance law. Our firm is adept at both types of cases, enabling us to provide superior service to clients who need help navigating complex settlement negotiations and, when necessary, litigation.

Call Burg Simpson at 303-792-5595 to speak with a qualified bad faith insurance lawyer. Your initial consultation is FREE and 100% confidential. Our attorneys serve clients in and around Denver and throughout Colorado.